What are the types of AAA credit certification and what are the benefits of doing AAA for enterprises?

日期:2018-08-23编辑:Zhongxin Certification游览:5558次来源:internet

What is AAA Enterprise Credit Rating Certification?

AAA enterprise credit rating is an industry credit rating evaluation work jointly implemented by the Ministry of Commerce and the State owned Assets Supervision and Administration Commission by rating agencies according to certain methods and procedures. It is an evaluation of the reliability and safety of a company's credit behavior based on comprehensive understanding, investigation, research, and analysis by professional institutions.

What are the categories of AAA corporate credit ratings?

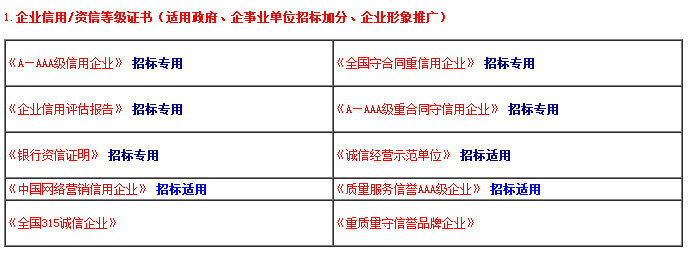

AAA Credit Rating, AAA Credit Rating, Honest Supplier, Contract abiding and Creditworthy Unit, Contract abiding and Creditworthy Enterprise, Quality Service Integrity Unit, Integrity Demonstration Business Unit, China Industry Integrity Sales, Quality Service Credit AAA level Integrity Enterprise, etc.

So, what are the roles of different categories in the bidding process that companies are most concerned about, and which ones are essential?

Please refer to the relevant documents for the specific role of different AAA categories in bidding.

What are the benefits for businesses?

1. In a market economy environment, enterprises must establish their own credit image

Market economy is a credit economy, and credit is an indispensable part of the operation of market economy. Maintaining and developing credit relationships is an important prerequisite for protecting the order of social and economic activities. With the development of socialist market economy and the gradual establishment and improvement of China's capital market mechanism, the issue of corporate credit has received increasing attention from the government, society, and enterprises. Therefore, enterprises must attach importance to their own credit status.

2. Credit is an intangible asset of a company and a basic condition for engaging in various businesses

Credit rating is a genuine and reliable passport for all enterprises in market economic activities. The various fundraising and business activities of enterprises require the establishment of a credit relationship between the enterprise and society, and the level of enterprise credit plays a key role in the formation and continuation of this credit relationship. At present, the results of corporate credit evaluation have been widely applied in fields such as issuing corporate bonds, loans, bidding, and commercial negotiations.

3. Enterprise bidding requires providing a credit certificate

The basic way for enterprises to explore the market is through bidding. Many units such as PetroChina, Sinopec, and State Grid require customers to provide credit rating certificates issued by third-party institutions during bidding. At the same time, credit rating, as a bonus item in bidding activities, is increasingly being valued by bidding enterprises. With the continuous improvement of the credit system construction, especially after China's accession to the World Trade Organization, according to international practice, professional credit rating agencies will become the mainstream in the market to rate the credit rating of bidding enterprises.

粤公网安备44030002007599号

粤公网安备44030002007599号